Do you have back tax debt or another IRS problem you’re trying to solve? You might have found Precision Tax Relief online while researching your issue. Learn all about Precision tax and accounting tools. Real Precision Tax Services reviews can help you decide if this company is right for you.

About Precision Tax Relief

Precision Tax Relief is a tax resolution company in Coeur d’Alene, Idaho. Their team of 50 people includes experts in law, business, finance, and accounting. Some team members are IRS-enrolled agents. Precision Tax services include the following options:

- Back Tax Returns

- IRS Offer in Compromise

- IRS Revenue Officer Assistance

- Payroll Tax Debt

- IRS Levy

- IRS Bank Levy

- IRS Wage Levy

- Federal Tax Liens

- IRS Hardship Status

- IRS Payment Plan

- Penalty Abatement

- Current Year Tax Preparation

- Bookkeeping Service

- Innocent Spouse

The Precision Tax Relief Process

Precision Tax lets you start the process with a free consultation. They’ll learn about your situation over the phone, then design a plan to tackle your problem. Precision Tax Services provides your plan and a price guide after your consultation.

If you decide to work with them, Precision Tax Relief will work with the IRS to solve your case. They aim to stop IRS collection attempts while negotiating a compromise amount.

How much does Precision Tax Relief cost? This information isn’t available online. Precision Tax states that you’ll receive a cost estimate after your free consultation. However, you can’t find their prices without contacting them for more details.

Is Precision Tax Relief Legitimate?

Precision Tax Relief offers many benefits on its website. Here are some of the reasons you might want to work with them:

- Free consultation

- Online chat services

- Represent clients across the country

- Decades of experience

- Flat-rate pricing model

- Member of professional tax groups

Precision Tax Services Reviews

One way to learn about a tax company is to read reviews from their clients. Precision Tax Services reviews let you know what real people think about this company. Explore the Precision Tax Relief ripoff report to learn what to expect as a client.

Precision Tax Relief BBB

5 out of 5 stars, 10 total reviews

The Precision Tax Relief BBB profile has had some reviews from clients over the past three years.

Precision Tax Relief Yelp Reviews

5 out of 5 stars, 4 total reviews

There aren’t many Precision Tax Relief Yelp reviews posted. The reviews that are posted are a few years old.

Precision Tax Relief Reviews On Facebook

5 out of 5 stars, 7 total reviews

This negative comment was posted 8 years before publication.

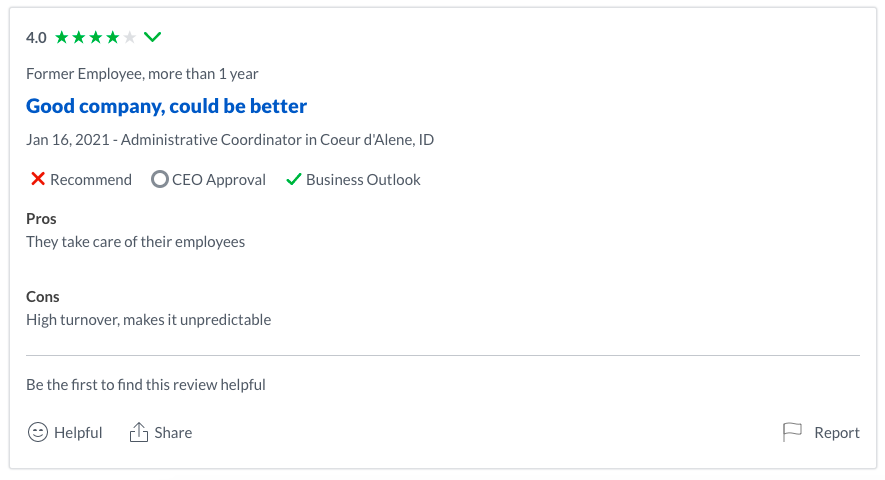

Precision Tax Relief Reviews On Glassdoor

3.2 out of 5 stars, 2 total reviews

This employee mentions that high turnover makes the working environment unpredictable. High turnover can also mean your case gets lost in the shuffle.

Red Flags About Precision Tax Relief

You can use online information to learn about a tax company. At first glance, Precision Tax Relief might seem like a decent company to work with. There aren’t many Precision Tax Relief complaints posted online. Many Precision Tax Relief reviews are positive. However, there are some red flags to consider before becoming their client.

- The website mentions more than 1000 positive reviews, but few reviews can be found

- Little information is given about most team members

- No pricing information given without a consultation

- Don’t represent clients during IRS audits

Are Tax Relief Services Worth It?

If you’re buried under back taxes or IRS debt, you know that tax problems are a serious matter. Tax debt can quickly mount up once the IRS starts charging interest. This growing debt can make it hard to catch up or plan for the future.

For people with tens or hundreds of thousands of dollars of tax debt, tax relief services are absolutely worth it. Businesses like IRS Tax Relief Network can help you settle your tax bill for much less than you owe. You may be able to clear your account with a very low payment. You’ll find much better results than if you work with the IRS directly.

One important thing to remember is that not every tax company is trustworthy. Some businesses have your best interests at heart, but others are just in it for the money. Make sure to choose an honest tax company, not one that takes advantage of people going through a hard time.

Do These Tax Relief Companies Really Work?

Yes, tax relief companies can save you huge amounts of money. If you owe more than $10,000 in tax debt, IRS Tax Relief Network can help you use the IRS Offer In Compromise program. This program allows us to make a compromise with the IRS on your behalf. Many clients can clear their accounts with a small payment that’s much less than what they owe.

Choose an honest tax company if you want to use the Offer In Compromise program. Tax resolution services from IRS Tax Relief Network offer the best strategies and tools, all while keeping your needs in mind.

The Top Mistake People Make With The IRS

If you’re facing tax trouble, it can be tempting to ignore the situation. Dealing with the IRS can be complicated and scary. The government places serious punishments on people who miss tax payments. It’s no surprise that many people want to ignore their tax problems.

Trying to forget about your tax debt is the worst choice you can make. You might want to ignore the IRS, but the IRS isn’t going to forget about you. The government can legally collect your tax bill for up to ten years after it was due. The IRS also employs many people who focus on tax collection. Your tax problems won’t go away if you ignore them.

The government can try many strategies to collect your taxes, even if you don’t respond to letters and notices. You might face the following punishments:

- Garnished wages

- Liens on your home or other property

- Bank levies

- Blocked passports

- Criminal charges

- Jail time

What Is The Best Tax Reduction Agency?

Tax problems can happen to anyone. We believe you deserve to enjoy financial freedom. Find a tax company like IRS Tax Relief Network that truly cares about you as a person. We learn about your unique needs and build a plan that’s perfect for your situation. Our tax experts have helped clients save thousands of dollars through IRS negotiations.

Old tax debt doesn’t need to define your life anymore. Explore our simple, straightforward strategies for regaining financial peace of mind. Most of our clients never need to talk to the IRS themselves. Our offices are open from 6 a.m. to 6 p.m., Monday to Friday, so we’re ready for your call. Click here to learn more about IRS Tax Relief Network and start to resolve your tax debt now.

Owe the IRS $10,000 or more? Click the banner below