If you’re living with tax trouble, you know that the process can be hard to handle. Tax debt is frustrating and can take over your life. Tax resolution can help, but you need to learn about your tax company before getting started. Learn about Optima Tax Relief reviews and see what you think about this option.

About Optima Tax Relief

Optima Tax Review is a tax resolution company based in Santa Ana, California. The Optima team has over 25 years of tax experience. They can represent clients in all 50 states as well as people living abroad.

Optima Tax Relief provides the following services:

- Tax consultation

- Tax preparation

- Tax relief

- Tax resolution

- Tax settlement

- Protection plans

- Tax audit support

- Stopping liens, garnishments, and other penalties

- Offer in Compromise (OIC)

- Penalty Abatement

- Installment Agreement

- Partial Pay Installment Agreement (PPIA)

- Tax Lien Discharge

- Tax Lien Subordination

- Tax Lien Withdrawal

- Wage Garnishment Release

- Bank Levy Release

- Innocent Spouse Relief

- Currently Non-Collectible

- Statute of Limitations

- Collection Appeal

- Administrative Appeal

Why Choose Optima Tax Relief?

You should explore all the Optima Tax Relief pros and cons before making a decision. Here are some of the benefits that Optima Tax Relief offers on their site.

- Tax attorneys and IRS-enrolled agents on staff

- The staff has a legal, business, and accounting experience

- Senior staff is clearly listed on the website with pictures and biographies

- The company and staff are members of professional groups like the California State Bar and the National Association of Tax Professionals

- Recognized by major media outlets as a trustworthy company

- Free tax consultation

- Timeline of services

Optima Tax Relief Reviews From Actual Clients

User reviews are a great way to learn more about a company. Check out our Optima Tax Relief ripoff report to see what previous customers think about their experience.

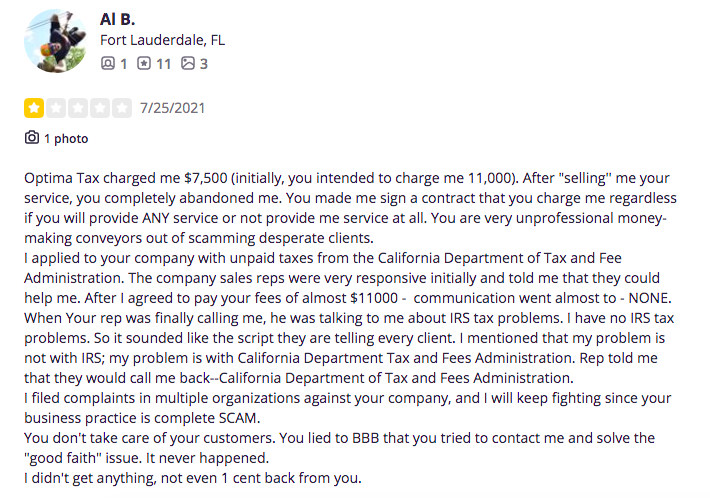

Optima Tax Relief Reviews Yelp

2.5 out of 5 stars with 231 total reviews

Optima Tax Relief has many negative reviews on Yelp. Here is an example posted 1 month before publication.

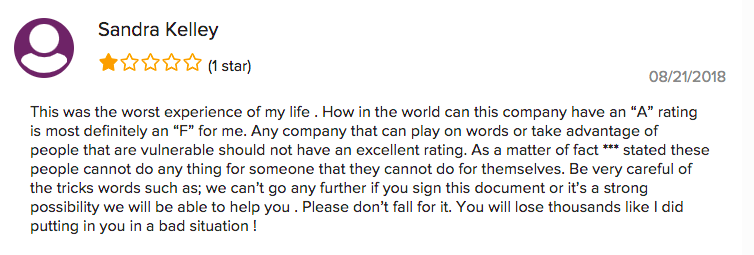

Optima Tax Relief BBB Complaints

4.6 out of 5 stars with 2,749 total reviews

Optima Tax Relief has positive reviews with the Better Business Bureau, but they also have almost 600 posted complaints. Here is a worrying review posted 2 years before publication.

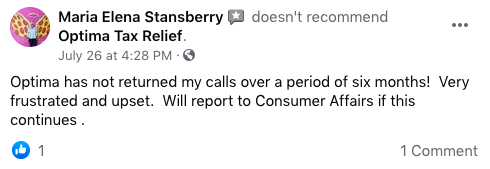

Optima Tax Relief Facebook Reviews

4.3 out of 5 stars with 594 total reviews

Here is a negative review posted one month before publication.

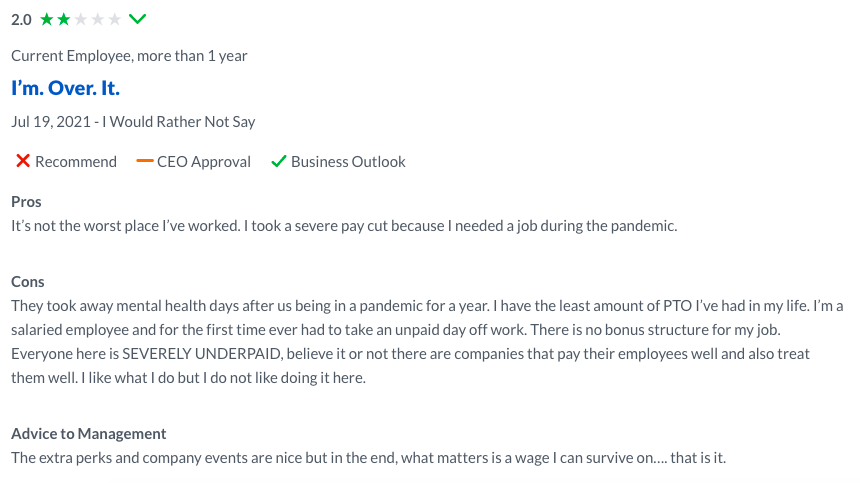

Optima Tax Relief Glassdoor Reviews

4.5 out of 5 stars with 373 total reviews by employees

Not all Optima employees feel supported or valued in the workplace. This review is from one month before publication.

Is Optima Tax Relief Legitimate?

Make sure to learn about Optima Tax Relief before signing a contract with this company. Some clients have been happy with their services, but others have been very disappointed. There may even be a class-action lawsuit against Optima Tax Relief.

Think about these concerns before going ahead.

- Mixed reviews, with many negative reviews on Yelp

- Many bad reviews claim that Optima stops contacting clients without resolving their problems

- The nine senior staff members only have 25 total years of tax experience, averaging less than 3 years per person

- No CPAs or accountants listed on the staff

Decide for yourself if Optima Tax Relief is a company you want to work with.

How Do I Get My IRS Debt Forgiven?

Tax debt can cause you many problems and feel like it’s taking over your life. If you have overdue taxes or owe IRS money, it’s time to face your problems and take action. Companies like Optima Tax Relief promise to solve your tax issues. It’s important to find a company you can trust before using their services.

Tax relief companies work with the IRS to solve your problems. There are many options to resolve your tax debt. The IRS might be willing to make a compromise, meaning you can pay some of your back taxes instead of the entire amount. This can save you huge amounts of money and help your life go back to normal.

Watch out for dangerous companies that want to take advantage of you. Many tax relief companies are honest, but some try to scam people who are in bad situations.

The #1 Mistake People Make When Working With The IRS

Tax problems are scary. It might seem easier to ignore them and hope they go away. However, the IRS isn’t going to forget about your debt. The government can take up to ten years to collect your money. It’s almost impossible to wait out your tax problems.

The IRS also has lots of ways to try to collect from you. Many IRS agencies specialize in collecting tax debt. If you don’t pay your bill, the IRS can take the following steps:

- Garnish your wages

- Keep your tax refunds for future years

- Place a lien on your house or other property

- Block your passport

- File criminal charges that can lead to jail time

These penalties can make life very hard. How long does Optima Tax Relief take to solve your problems? If you’re living with garnished wages, liens, or other penalties, you don’t have time to waste.

What Is The Best Tax Relief Company?

When you have tax problems, you need to work with the best company. Explore your options with a tax consultation from IRS Tax Relief Network. Our team of experts will learn about your situation and help you understand your options.

We’re ready to help whether you have tax debt, un-filed returns, are being audited, or have another issue. We offer a clear timeline to all of our clients so you know just what to expect. In most cases, you’ll never need to talk to the IRS yourself. The IRS Tax Relief Network makes it easy to move past your tax problems. We’re open from 6 a.m. to 6 p.m., Monday to Friday. Give us a call and learn how to resolve your tax debt here now.